When the Auto-Renewal Bites!

This blog is on the fascinating topic of Insurance, haha. Why?

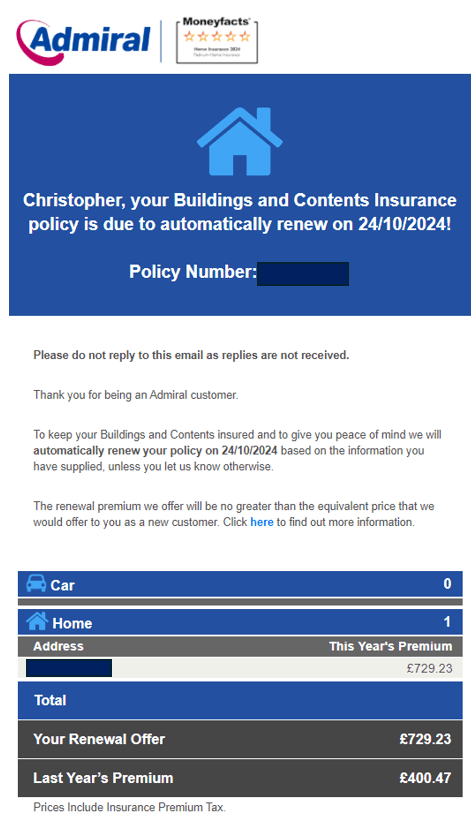

I recently received my home insurance renewal notice from Admiral. The banal and mundane adulting that everyone needs to do.

Like all of you, when you get the reminder email, you will auto-renew and think, ah shit, I haven’t thought about that hit, just as I’ve booked a gig.

Anyway, I didn’t expect the figure staring back at me: £729.23. Last year, this policy cost me £400.47. That’s an 82% increase—yes, 82%! for a two-bedroom flat in Glasgow….

In times of inflation, I understand that prices rise. Things cost more, materials cost more, and services cost more. But what happened here wasn’t inflation—it was greedflation.

The premium for my home insurance jumped from £400.47 to £729.23—a staggering 82% increase.

This increase isn’t just the result of increased costs. It is calculated price gouging that corporations have learned they can get away with, using inflation or any other random global event as a convenient excuse—Ukraine, Oil & Gas, COVID-19, etc.

If I didn’t already know that insurance companies were masters of ripping people off, I certainly do now. See the Campaign from Which?

A Corporate Playbook: Exploiting People with a Smile

Like most folk do these days, I reached out to Admiral on Social Media at the absurdity of the email. I didn’t bother phoning and speaking to someone over the phone, some poor, probably minimum-wage person from a working-class area being exploited to hit call targets on customer churn, satisfaction and sales ( I say this with confidence as I previously worked for Three, Royal Bank of Scotland and Teleperformance on the phone – the first time I have had to put a code in the phone for going for shit).

So a bit of public shaming would garner an explanation or a callback.

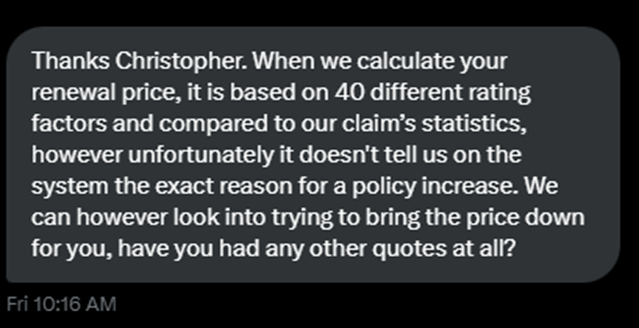

Instead, I got a customer service rep or bot, who (as you can see on the screenshot) told me that my premium was determined based on “40 different rating factors” and compared against their claim statistics. Obviously, they won’t tell me exactly why my premium had increased by such a ridiculous amount.

This kind of vagueness isn’t just frustrating—it’s deliberate. Comfort in Chaos, being suitably vague to avoid actual scrutiny.

It prevents people from understanding the actual reasons behind these hikes and leaves us in the dark.

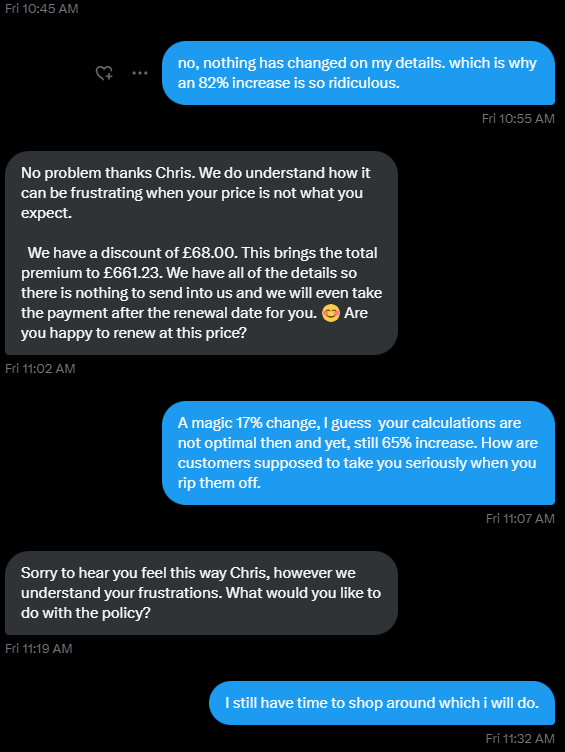

After a bit of Twitter ping-pong, they magicked me a £68 discount, bringing my renewal down to £661.23. This is a seemingly “generous” offer, but it is still a 65% increase from last year.

The fact that they could instantly reduce the price by 17% shows that their initial offer wasn’t optimal but rather inflated to test how much they could charge without losing me.

Keeping in mind, and I trust you trust me, I have had no changes to my property, no claims, and no significant changes to my details.

This hike was a standard, automated hike that people are subjected to under the guise of risk calculation and market adjustments.

This move isn’t the invisible hand of the market at work; this is a closed fist squeezing customers, knowing that most of us lack the time, energy, or even options to fight back effectively.

Capitalism Baby!

So why is my home insurance increasing by 82%? Is Admiral going bust and operating time margins and in financial straits, needing regular punters to shoulder costs? No.

Doing a bit of digging, I went to the recent financial statements for Admiral Group and oh they tell a different story.

In 2023, Admiral reported pre-tax profits of £442.8 million, an increase from the previous year’s £361.2 million.

The oh so hard-working CEO, Milena Mondini-de-Focatiis, enjoys a compensation package of over £2 million per year—35.7% in base salary and the rest in stock options and bonuses – obviously having your personal earnings linked to stock options won’t lead to stock manipulation….yes there was previously laws on this, but Thatcher and her bin fire of an ideology got rid.

The company also maintained an extremely generous dividend payout ratio of around 71% (In layman’s terms, the dividend payout ratio represents the percentage of a company’s earnings that is paid out to shareholders as dividends. A high payout ratio means that the company is returning a large portion of its profits to shareholders rather than reinvesting it in the business.) ensuring shareholders remain well-fed….

I mean how do you feed that insatiable greed when your earn so much compared to the folk you are supposed to be insuring.

These figures highlight that Admiral is not struggling.

Instead, they are fat and rich, all while passing inflated costs onto customers like me. The massive profits and executive payouts paint a clear picture of where the Money is going.

Meanwhile, ordinary customers are being shafted. It is regular folk who are left with unjustifiable costs.

The gap between the corporate rhetoric and the reality couldn’t be starker.

So forgive me, when I hear people say “cost of living”, I just say fuck off, this is a cost of Capitalism and Corporate Greed.

Greedflation: A Pattern We Can’t Ignore

What Admiral has done here fits perfectly into the concept of “greedflation”—an economy where prices are inflated well beyond what could be justified by underlying costs. Robert Reich bangs this drum a lot because the UK isn’t as bad as its big brother, the US.

So here, I’ve seen it not just in Insurance but across all sectors from the Supermarkets aisles, utility bills, and almost every other aspect of daily life.

Corporations raise prices and blame the “market,” while their financial reports show increasing revenues and profits.

This is not a case of unavoidable costs being passed down; it is opportunistic profiteering. The inflated prices are not about survival—they’re about maximising profits.

Consumers are told to shop around, to “understand the market,” but every provider seems to be engaging in the same behaviour. It’s a collective squeezing of people who have no real choice.

The sycophants and nodding heads of this system tell us this is the market. The ignorant believe the press that it’s just inflation, and the scabs tell workers not to go on strike to keep up with inflation because they somehow are the cause.

Workers are chasing price rises, not the other way around as Mick Lynch said during strikes, it isn’t wage-price spiral – it’s a profit-price spiral.

Not Just a Consumer, but as a Citizen

So, what can I do. I refused to renew my policy. I will shop around, and I hope to find a company that will be more reasonable. I might not get something cheaper.

As Money Saving Expert has posted too – Home Insurance is up nearly 30%.

The failure here is one where corporations have too much power over the essential services we need.

This power imbalance is caused by a lack of oversight or consequences for price gouging.

Starmer and Co, have growth at any costs, reneging back on anything that might impinge him and his cronies from getting their next five figure suit.

Greedflation needs to be called out for what it is—corporate exploitation. Stronger consumer protection and better oversight are required to hold these companies accountable.

Until then, we’re left comparing numbers, trying to outmanoeuvre algorithms designed to extract as much profit from us as possible. It’s time we demand more—not just as consumers but as people who deserve fair treatment.

So who do we turn to?

Martin at Money saving expert? The Government?

You tell me?

Read More – A few things that might help.: Greedflation Hits Home

Leave a comment